Banking Regulations (Basel IV) Minimum Capital Requirement Calculation

Banking Regulations (Basel IV) Minimum Capital Requirement Calculation

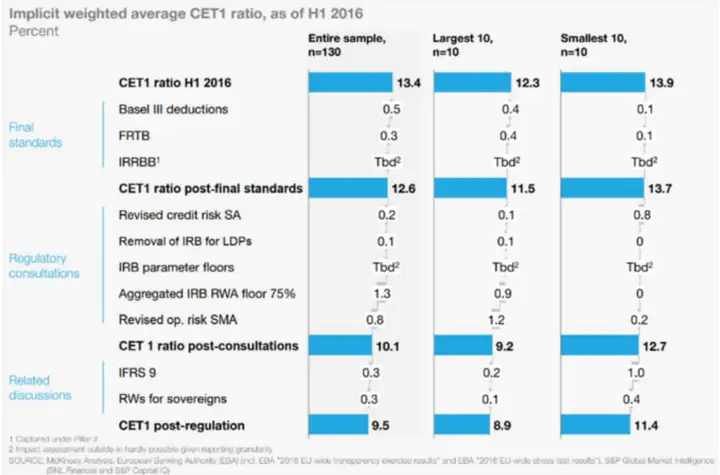

Banking Regulations (Basel IV) Minimum Capital Requirement CalculationThe Basel IV are some modifications to global bank capital requirements of 2017 and should be implemented in January 2023. Indeed, Basel IV is a collection of standards & proposals that define the way Basel III is implemented in the future The suggested revision modifies the risk- weighted assets (RWA) and internal ratings approach, and introduces some regulatory capital floors.

In the area of Standardized approach to credit risk which is utilized by a vast majority of banks, Basel IV modifications provide a granular risk weight and risk sensitive approach. For instance, it

encourages using loan to value ratio of the mortgages to determine mortgage risk instead of using flat risk weights. This change of approach covers areas like banks, corporates, residential real estate, commercial real estate, equity and subordinated debts. In the area of internal risk based approach to credit risk, after the global financial crisis, the limitations and over complexity of the existing model became clear. As a result, for some banks that have supervisory approval, use of F-IRB instead of A-IRB approach was suggested. The reason is that in this way instead of estimating parameters like PD, LGD, EAD, which results in RWA variability, some fixed values can be used. Furthermore, a set of input floors for IRB parameters are specified in the modified framework. There exists a look up table that determines the minimum values of PD, LGD, and EAD for corporate and retail classes. Other modifications of existing IRB approach are increasing haircut of collateral and decreasing LGD parameters for non-financial collaterals and decreasing LGD parameter to 40% for non-financial corporates.

In the area of output floor, according to the new modifications, banks’ RWA should be considered as the maximum of total RWA obtained by both internal model and standardized one, and 72.5% of RWA obtained by standardized model.